India Together carried this piece on why India's current account deficit is a matter of concern for the common man. The piece is reproduced below with some pointers to data surces.

India had a deficit on its current account of nearly

$90 billion last year (2012-13).

The current account is a record of transactions

relating to exports, imports and cross border income transfers for a given

period, transactions that require a foreign currency. A deficit on the current

account means that India has to pay out more than it receives on these

transactions. The deficit can be bridged using the country’s foreign exchange

reserves or from foreign capital inflows. The enormity of last year’s deficit can be seen from

the fact that it exceeds the value of exports of the entire computer software

and service industry.

In recent years, the current account shows an interesting

variation, with a sharp inflection in 2004-05. India actually had a surplus on

its current account – foreign exchange to spare – for some years, until the sharp

reversal of 2004-05. Since then, the current account deficit (CAD) has

increased at a very rapid rate.

The CAD has

generally been balanced by the inflow of foreign capital coming in a variety of

forms – direct investments, portfolio investments, corporate loans and deposits

of non-resident Indians. Unsurprisingly, the capital flows have been determined

not only by the opportunities available in India for profit, but also the

global economic environment.

In the years before the 2008 global financial

crisis, capital inflows comfortably covered the deficit and added to India’s

foreign exchange reserves. The situation changed dramatically in 2008-09 with

capital inflows falling short of a sharply rising CAD. India had to draw on its

foreign exchange reserves to finance imports that year. In the following years,

capital inflows have been just about keeping pace with the increasing CAD,

except over some quarters of 2011 when there was again a shortfall with a draw

down on the reserves.

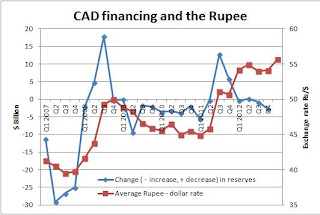

The figure below shows the quarterly changes in

the foreign exchange reserves after accounting for the current account deficit

and net capital inflows (blue line, left vertical axis) for the last five years.

A decrease in the reserves implies that capital inflows were not sufficient to

balance the CAD in that quarter.

There are immediate and longer term negative

consequences for the economy from depending on capital inflows to finance a

large part of the imports.

One long term consequence with a bearing on the CAD

is that with the increasing debt component of foreign capital in India (now

exceeding 52%), interest payouts have also increased adding to the deficit. In

2012-13, net investment income transfers constituted over 25% of the CAD.

Among the immediate consequences are the volatility

and rapid depreciation of the rupee. The figure displays the quarterly

average rupee – dollar exchange rate for the last five years (red line, right

vertical axis).

Periods when capital inflow is inadequate to finance

imports leading to a net depletion of foreign exchange reserves see sharp

depreciation in the value of the Rupee. Two such recent periods were from Q3

2007 to Q4 2008 when the Rupee depreciated by 27% and then from Q1 2011 to Q2

2012 when the fall was 22%.

That the value of the Rupee is acutely dependent on

the delicate balance of the CAD with capital inflows is only one part of the

problem. A large part of the capital

inflow – nearly 25% of foreign capital in India as of March 2013 - is portfolio

investment, money that can be withdrawn very quickly when investors perceive

better opportunities elsewhere. In a recent episode, the rupee depreciated by

over 13% in 8 weeks up to July 7 2013, exceeding Rs 61 to the dollar, after

foreign portfolio investors started withdrawing capital from India on

indications of higher interest rates in the US.

The government’s economic managers, who swear by the

dictum that the “market knows best”, do not find any call for intervention.

They preach that the Rupee depreciation may actually be a blessing as it will

spur exports by making them more competitive.

For the average citizen, however, the sharp Rupee

depreciation imposes severe hardships by making essentials such as energy,

fertilizer and edible oil more expensive and fuelling across the board

inflation.

Roots

of the Deficit

So why is the CAD growing so rapidly?

There are five items that constitute the

overwhelming part of India’s current account. These are merchandise exports,

software exports, and remittances (by Indians working abroad) all of which earn

foreign exchange for the country and merchandise imports and net investment

income payouts which involve foreign exchange outflow. The excess of merchandise

imports over exports constitutes the merchandise trade deficit.

In the period up to 2003-04, exports and imports

followed a similar rising trajectory. Though there was a deficit in merchandise

trade, software exports and remittances from Indian workers – essentially a

form of export of labor services - compensated for it, leaving an overall

surplus on the current account.

From 2004-05, even a robust growth in software

exports has been unable to compensate for the rapidly climbing merchandise

trade deficit.

Imports have been growing at a compounded annual average

growth rate (CAGR) 4% higher than that of exports in this period. This is the

cause of India’s burgeoning current account deficit. Clearly this is not an

overnight problem, but has been building up for nearly a decade.

Import

growth – a closer look

Why have imports grown so rapidly in value – at a

CAGR greater than 22% - from 2004-05 onwards?

There are several causes.

One is the steep rise in the global price of

commodities such as crude oil and gas, gold, coal, metal ores and scrap which

India imports. Commodity prices have also affected the prices of manufactures

that use them as inputs, such as fertilizers and synthetic rubber which again

are on India’s import list.

The import bill has also gone up because of greater

imports of commodities, intermediate goods and capital goods for meeting the

needs of increasing exports and higher consumption in India. Production of

natural and synthetic rubber has, for example, has more or less stagnated in

India, requiring increasing synthetic rubber imports to enable the increasing production

of tires for local consumption and export. In the case of fertilizers and

petroleum gas, there has been a rapid increase in consumption. In capital

goods, there have been huge cumulative imports of items in categories such as

ships and floating vessels, aircraft and parts and power plant equipment.

However, that is not all. Consumer product imports -

imported whole or in parts to be assembled – have risen sharply. The telecom

revolution is almost entirely based on imports. So is the case with the spread

of computers and consumer electronics. High end brands of products

traditionally made in India – apparel, shoes, cookware, etc - are being

imported.

The government, on its part, has actively encouraged

imports through policy measures.

Import duties have been progressively reduced across

the board. According to Planning Commission data, the weighted average import

duties for capital goods fell from 20.7% in 2003-04 to 5.6% in 2009-10 and for

intermediate goods from 23.6% to 6.8%. Most remarkably, the duties on consumer

goods were brought down from 51.8% in 2003-04 to 42.9% in 2004-05 and

progressively down to 12.5% by 2009-10. Customs duty across the entire range of

mobile phones is now only 1%.

Gold has also been favored with official largess.

The duty rate on gold bars was slashed in 2002-03 and kept ridiculously low -

in the region of 1% - 2.5% - till early 2012. Preferential treatment under FEMA

regulations ensured a smooth and uninterrupted supply of imported gold.

Investment in gold was made easy by authorizing retail sales by banks of bars

and coins, trading in commodity exchanges with possibility of taking physical

deliveries and through gold ETF’s ( accorded the same tax treatment as debt

mutual funds even though the gold with these ETF’s served no productive

purpose). In 2002-03, gold already accounted for 6.3 % of India’s import bill.

By 2012-13, gold imports had gone up 8 times in value and constituted nearly

11% of the import bill.

The

public interest in restricting imports

The basic imbalance in merchandise export and import

growth points to serious problems with Indian manufacture and the overall

pattern of economic development in India. The underpinnings of the growth of

the last decade need to be carefully examined. There are serious questions

about the excessive import dependence of many sections of Indian industry and

its lack of its export competitiveness in all but a few areas. These are

questions that the government’s economic advisors really need to dwell on.

If the CAD is to be tackled head on, there can be

only two ways: increase exports or reduce imports. Increasing exports would

take time, even if the government had some new ideas on how to go about it. It

seems obvious that the immediate efforts should center on curbing imports.

Gold stands out as the prime candidate, constituting

nearly 11% of the import bill. According to different assessments (World Gold

Council, an association of gold miners and the All India Gems and Jewelry

Federation, the main association of jewelers in India) fully one third of the

gold imported is sold in the form of bars and coins to investors, with the rest

going into jewelry (part of which is exported). Investment in gold (which has

to be paid in dollars) can be looked upon as a form of ‘capital flight’ out of

the country. Wealthy Indians have parked in the range of Rs one lakh crore in

gold in just the last year obviously to hedge against inflation and rupee

depreciation. A clamp down on investment gold would be fully justified.

Cutting down gold imports is not the only option.

Last year, $5 billion worth of gold jewelry was imported into India, a country

that specializes in making gold jewelry! Imports of mobile phones over the last

3 years averaged $ 5 billion annually with even the most expensive mobile

phones attracting only 1% duty. India has thrown open its gates to every

variety of high end foreign goods and there are pockets here which can afford

these. If the choice lies between restricting access of a rich minority to high

end imported consumer goods and ensuring supply of essential commodities at stable

prices to all, then surely public interest lies in the former.

So what is the government doing to bring down the

CAD?

Shockingly, it seems next to nothing.

The Minister of State for Finance stated in a

written reply to a question in Parliament in May 2013 that “no target has been

set for the CAD”. He talked of measures taken to “boost” exports and reduce

imports of gold and diesel. The measures for export are in the nature of

increased subsidies to exporters and more relaxed norms for setting up SEZ’s. The

import control measures, according to the Minister, are a higher customs duty

on gold and higher administered prices for diesel. The government’s economic advisors

cannot be unaware that both gold and diesel imports have proved to be price

inelastic!

The Government has no real plans to correct the

merchandise trade imbalance that is at the root of the current account deficit.

Surprisingly, there is almost a conspiracy of silence on this issue. Neither the

mainstream media nor major political parties have questioned the government on stance

on trade.

The Government’s focus instead is entirely on

“financing” the CAD by attracting more foreign investment. It spends all its

energies in floating new external borrowing schemes or tinkering with existing

regulations governing foreign investment.

Leaving aside fortuitous circumstances – a sustained

fall in global commodity prices, perhaps, or a steady rise in “investor

sentiment” - India’s citizens are in for

many more bouts of imported inflation.